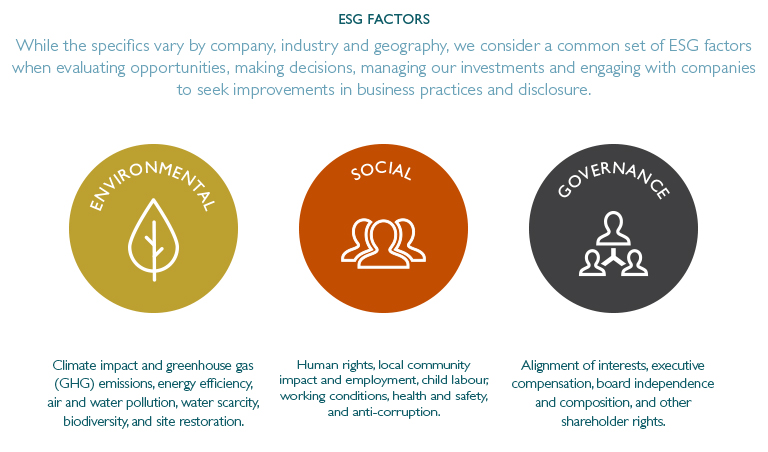

Esg: Environmental, social and governance criteria are increasingly important.

Responsible companies have excellent performance: this is why investors are increasingly aware of the environment, society, and governance.

Isabelle Mateos y Lago says, BlackRock’s global macro investment strategy (the world’s largest fund) declared:

Isabelle Mateos y Lago says, BlackRock’s global macro investment strategy (the world’s largest fund) declared:

It is time that environmental, social and governance criteria (ESG) become mainstream. It is no longer something involving a few individuals who embrace trees. In the search process of any BlackRock team, we always make sure that Esg factors are relevant.

This is also supported by the Financial Times: a particularly evident trend especially in emerging countries. Indeed, the MSCI Emerging Markets Leaders Index, which includes 417 companies with high ESG scores, starting from the financial crisis of 2008/2009, has now passed the MSCI EM benchmark.

The fact that led to increased attention on the Esg factors is its nature: it starts from the bottom: companies started to work to constantly improve their standards by attracting capital from investors.

This provides the opportunity to gather a new clean technologies and protect against the financial risks associated with climate change.

Christiana Figueres, the United Nations chief, has proposed to the world of finance to invest 1% of its assets in renewable energy.

She sets a deadline: by 2020.

In a conference of the United Nations Investing Principles for Investments held in Berlin from September 15 to 27, the manager intervened with a video message calling on the signatories of UN Principles to save investment part of the global ecological transition process needed to combat climate change.

A hot topic, therefore, that Figueres deals with this:

Dear friends, this is the challenge that we launch.

The date of 2020 is the point of no return for the Earth, as well as published on Nature:

Investments will trigger a domino effect that will decarbonize billions of dollars a year from now to 2020: an opportunity for investors to become the true protectors of the world economy over the years to come.